Insurance for your historic MV: don’t leave home without it

What to look for, where to look for it, and why you need it

April 20, 2010

by Brian Earnest

According to insurance companies, most of the claims made for

damage to military vehicles are for small things like dinged

windshields or damage to the paint. Occasionally, though, the

unthinkable can happen—like the rock damage to this DUKW.

Be sure you have the right coverage for your vehicle!

Insurance for military vehicles? Wow, that seems like the ultimate “can’t miss” racket. MV’s are normally rarely driven, often move only at glacial speeds, don’t have much on them that can break, and, for the love of Kevlar, a lot of them have armor! They are made for war, for Patton’s sake!

So why wouldn’t every insurance company from here to Istanbul not want in on the action? Why are there only a small handful of insurance carriers out there that will take your call if you finally throw down some money on that M37 you always wanted?

“I guess a lot of them just don’t have experience. They probably don’t know what they are dealing with,” surmised Cathy Moore Stark of Continental Western, one of the few U.S. companies that handles MV policies. “They don’t know values on military vehicles … And how tough they are! I mean, really, these things are designed to go into combat. It’s gonna take a lot to damage one of these. We insure tanks! It’s just very rare that we have a claim, period, involving any damage.”

Paul Jakubowski, a senior underwriter at JC Taylor, can’t put a finger on it, either. His company doesn’t have much competition in the MV world, and Jakubowski figures that isn’t going to change anytime soon. “Honestly, I really don’t know why [there are so few],” he said. “I think some people are just scared off by the size of some of these vehicles. But really, what’s the difference?”

So if there is bad news on the MV insurance front, it’s that there aren’t too many choices out there. The good news, though, is that insurance is generally a screaming bargain compared to insuring passenger cars, trucks and SUVs. A guy could easily go broke in the MV hobby, but it probably won’t be because of his insurance premiums. For the cost of a good steak dinner for two and a couple of pitchers of decent beer, you can have your 6x6 or even a tracked vehicle covered for a full year.

“Yes, they get very low rates,” said Moore Stark. “For a $10,000 vehicle, we could insure that for about $100 a year. It’s nuts. They get a good liability limit, medical pay coverage, uninsured and under insured motorist, and comprehensive and collision coverage.”

You can’t plan for accidents. This M38A1 flip-over resulted after

its owner loaned it to a teenage-driver during an MV show in

California.

Agreed Value

Some collectors will insure their vehicles, particularly jeeps and light trucks that will be driven extensively and are as much regular drivers as they are “collector” vehicles, through their regular insurance carriers with policies that are similar to their car policies. The most common insurance approach, however, is the “agreed value” arrangement where vehicle owners and insurers settle on a value for a particular vehicle and agree to a premium that can change if the market value of the vehicle changes.

“Agreed value is all we sell, and that works really smooth,” said Jakubowski. “On our policy it’s for unlimited [mileage] for hobby use, and for non-hobby we ask for not more than 2,500 miles a year … Our rates are relatively constant — we offer $3.50 per $1,000 of value …

“It doesn’t happen often, but if we get in a disagreement on a vehicle [value], we just ask the customer to get an appraisal, and really, that would only be if a customer is trying to get $200,000 coverage on a $25,000 jeep, and he’s trying to recoup what he might have invested in it, not what it’s worth.”

Continental Western also takes the “agreed value” route. “It’s almost impossible (to do it another way),” Moore Stark said. “Nobody wants that actual cash value option because that depreciates at the time of a claim … and you don’t want to undervalue your vehicle. You want to be reimbursed what it’s actually worth.”

Assigning a value to scarce or jumbo-sized vehicles is not always easy for either side, however. Because a high-dollar specialty vehicle or piece of Army surplus, heavy equipment only changes hands occasionally on the collector market, the science of insuring is pretty inexact. There are no price guides that assign values to the myriad vehicles that populate the MV hobby. Insurance companies are forced to do their own homework and make educated guesses. “It can be very difficult. We do a lot of research on the Internet,” admitted Moore Stark. “Sometimes, we just absolutely have to use common sense. And there are very few experts who appraise these vehicles, so we really have to rely on the marketplace.”

Typically, a customer will be asked to send in some photos of their vehicle and specify what the vehicle will be used for. JC Taylor’s 2,500-mile-a-year rule for non-hobby events means it’s okay to go for the occasional Sunday drive or day trip, but daily driving is against the rules. Rough play is also discouraged and can get you in trouble in a hurry with your insurer.

“Some guys take their stuff out in the field for war games,” Jakubowski noted. “And once in a while that’s fine, but you can’t do it every weekend. Once a year, or so, we’ll give you the benefit of the doubt, we just don’t want it to be commonplace.

“We look at auction results, look on the Internet, which is a wealth of information, try to find comparative values. And we try to check the information the customers give us — we try to make sure you’re not lobbing some shells over at the neighbors’ house before we give you a ‘yes’ or ‘no.’”

Ground Rules

Typically, insurers will want to know how many miles a customer will want to drive in a year, where it will be driven, if it will be doing any off-roading, and how many people might be in the vehicle. “With troop carriers, nobody is really allowed in back,” Jakobowski noted. “We restrict it to the cab portion only. We don’t want 15 or 20 guys in the back that we are on the hook for.”

Not only are insurers reliant upon customers to hold up their end of the deal when it comes to use, but also what the vehicle has on it. If you have machine guns, special lights, canvas or other obvious stuff that could get lost or wrecked, it’s best to include it in the photos at the beginning. On the other hand, sometimes it’s probably not a good idea to overstate your case, either. Calling extra attention to a vehicle’s weapons or special bells and whistles probably isn’t going to do you any favors when it comes to your premiums. “Basically, you rely heavily on photographs that you receive. They say a picture is worth 1,000 words, and that’s true. We look at the photos and you might see dents or mud in wheel wells,” said Jakubowski. “Or a torn interior. You can usually tell if it’s restored or not. With usage, it’s just a trust. If they say they aren’t going to use it, we believe them.”

And it might be harder to lie than customers think, too. Not only can a policy holder get caught in a fib about a vehicle’s use or value if an accident claim comes up, but they can also get tattled on by anybody with a grudge. “You’d be surprised with the number of calls we get to rat somebody out,” laughed Jakabowski. “We’ll write ‘em a letter basically getting them to conform. We’ll get them to sign a statement to say they aren’t going to take if of-road, or whatever.”

Hobbyist and MV owner Kevin Kronlund, who owns and operates Army Cars U.S.A. in Spooner, Wis., has arranged coverage through his regular car insurance company, but cautioned that one size does not fit all when it comes to MV insurance shopping. “Liability is a must,” he said.

“Everybody has to have that. But every individual needs to look at what he’s doing personally. If a person has one vehicle that he’s spent a lot of money on, of course he’s going to want more than liability. On the other hand, a person with a shed full of vehicles who can’t drive them all, he’s in a different situation.”

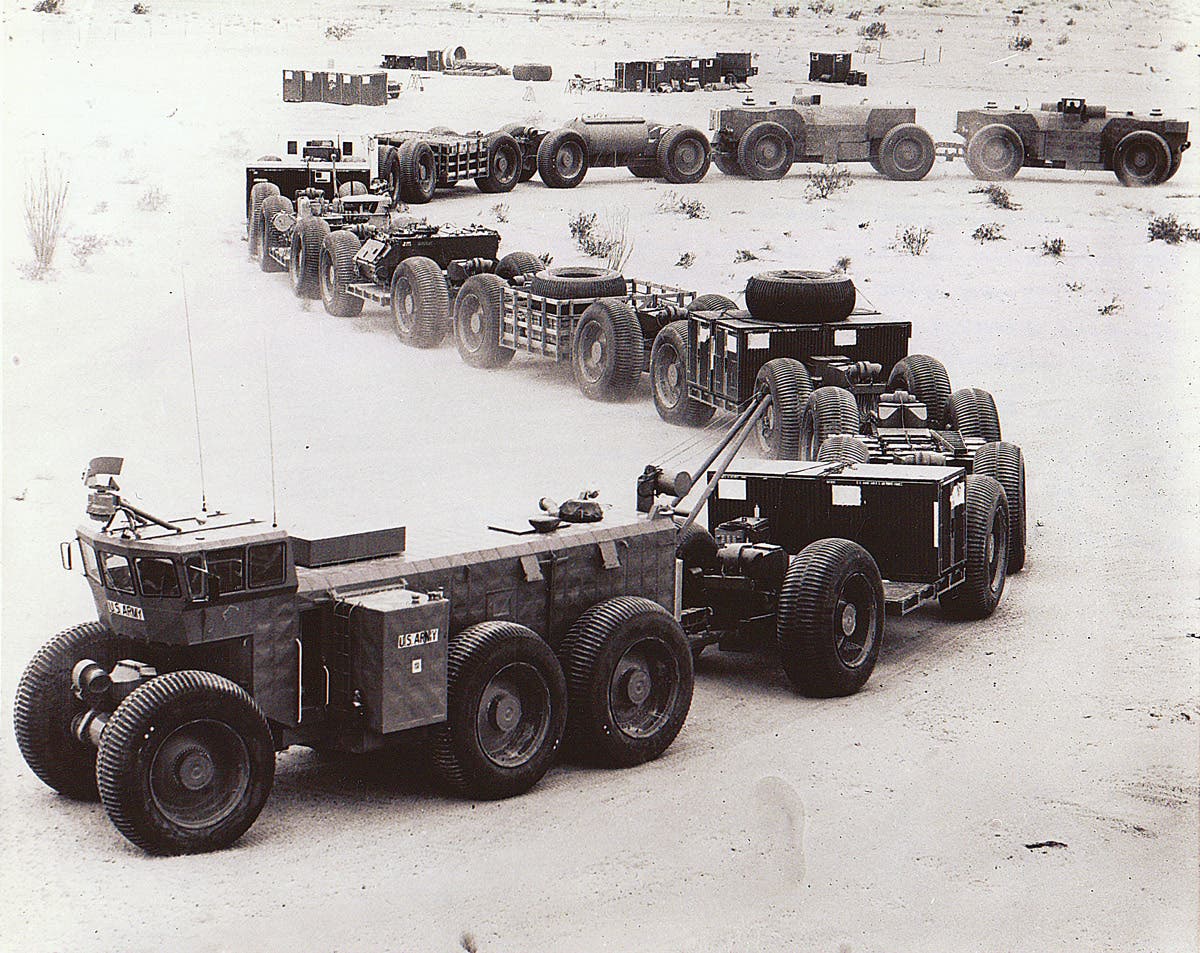

SIZE DOES MATTER

So what about heavy-duty rigs? Is there really much of a point in insuring a large machine that is practically bomb-proof and might not even be driven more than a few yards at a time? If you have a tank, do you really need an insurance policy on it?

“Yeah, I would,” said Bob McFarland, president of the Mid-South chapter of the Military Vehicle Preservation Association (MVPA). “For several reasons. If you go to an event and trailer it there, and take it off the trailer and you back into somebody’s vehicle, now all of a sudden you’ve got a problem. You’ve got a guy who’s wanting you to pay for his vehicle. And of course, if you ever run into somebody and hurt ’em, it’s highly advisable that you at least have liability. Even the MPVA promotes that.

“We have a museum down here … and we’ve got a halftrack, and JC Taylor insures it. We’ve got antique tags on it and we could drive it on the road if we want, but it burns so much gas and is so slow that we don’t do it if we don’t have to.”

A Low-Risk Proposition

The happy truth for both insurers and hobbyists is that MV insurance is rarely called into play. Claims are few and far between, and not many settlement checks ever need to be cut. Sure, there are hobbyists who like to beat on their old Olive-Drab machines, but they typically aren’t the type to make insurance claims over a few dents in their bumpers.

“And a lot of these guys are just car guys — they are the spit and polish guys,” Jakubowski said. “Their [vehicle] barely sees sunshine … Most of the claims that we do see are not really collisions, they are comprehensive claims. A stone will kick up and break a window, or at a car show somebody walks by with a zipper and damages some paint, or something falls off the garage wall and damages paint.

“These cars are heavy-duty, not like a Corvette or something. It takes a lot to damage some of these vehicles, plus a lot of them are so high off the road, they run over anything that gets in their way.”

Moore Stark, of Continental Western, agreed that mishaps between MVs and other vehicles are rare, and mishaps involving MVs and people are even fewer and further between. “Probably the most worrisome thing that could happen would be for someone to drive a military vehicle though a crowd at a parade,” she said. “Brakes can fail, and accidents can happen, but that’s extremely, extremely uncommon.

“Very rarely do we have a claim. You might see a fire claim once in a while, or a rock chip if you are doing a vehicle show or reenactment .. I don’t ever remember a total [loss]. I don’t know if I’ve ever see one. It’s usually kind of small stuff.”

RESOURCES FOR COLLECTORS

*Great Books, CDs & More?

*Sign up for your FREE email newsletter

*Share your opinions in the Military Forum