Rest Assured With Insurance

by Peter Suciu Along with death and taxes, some forms of insurance are inescapable. Driving a car in the United States — at least, legally, on public roads — requires…

by Peter Suciu

Along with death and taxes, some forms of insurance are inescapable. Driving a car in the United States — at least, legally, on public roads — requires auto insurance. To get a mortgage on a house, you typically need some form of home owner’s insurance. And today, unless you’re prepared to pay a penalty, you pretty much are forced to buy some sort of health insurance.

In all of the above cases, insurance is something you don’t want to pay for and really never want to use. For those same reasons, many collectors don’t ever think twice about “collector’s insurance.” The decision, for many, is an easy one: “Why pay for it when you hope you won’t need it?”

For others, there is the often-wrong assumption that home owner’s or renter’s insurance will cover collectibles including militaria, firearms, and even vehicles. However, just as how home owner’s doesn’t cover your car in most cases, it won’t cover military vehicles and often won’t cover specialized collections.

“Most of the time, homeowner’s insurance will have a $2,500 maximum for items of a collectible nature,” said Donald J. Rielly, Jr. of Eastern Insurance LLC. “That really equates to almost no coverage for many collectors. If you lose the collection in a fire you have no recourse. Those years you spent building the collection are lost, and it is very much like you just burnt up dollar bills.”

Determining Value

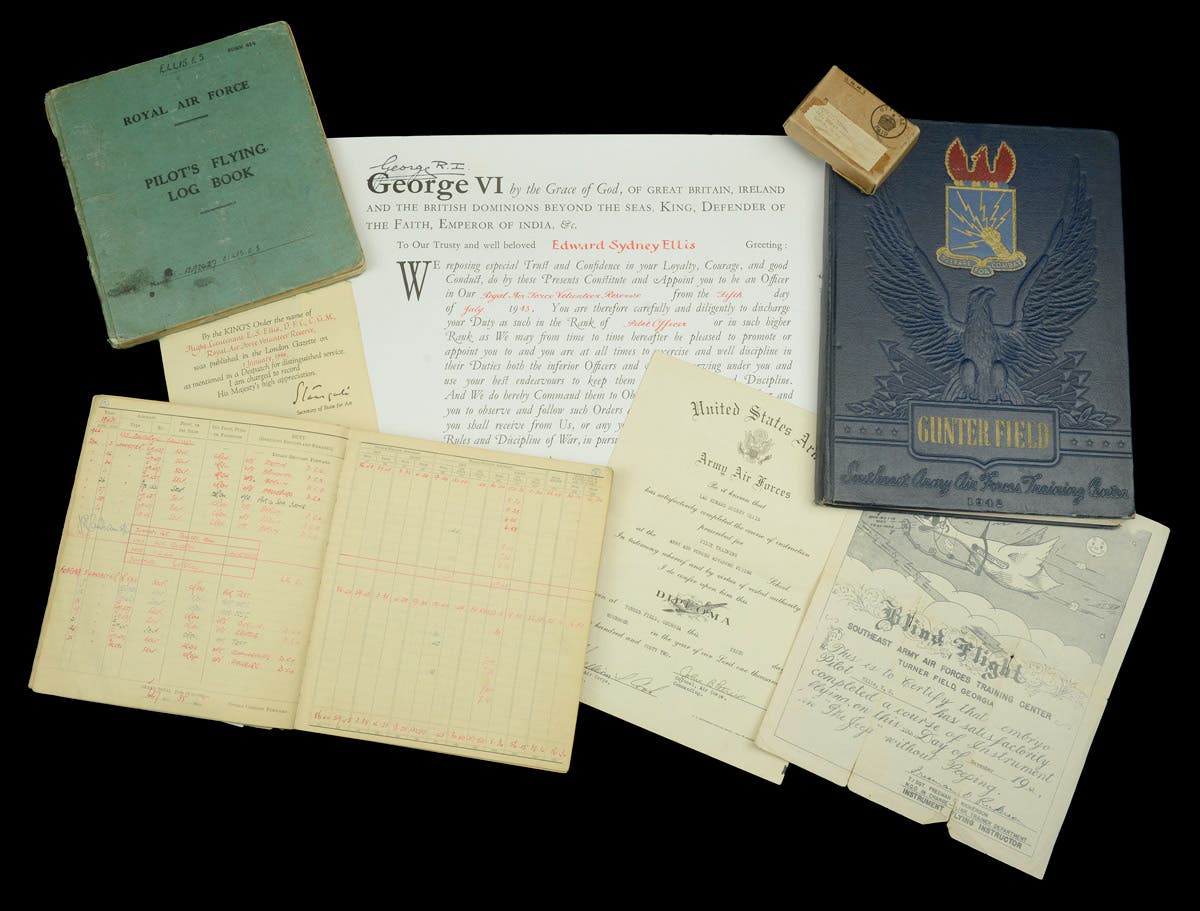

The first thing every militaria collector should do is take inventory of what they have in their collection. That same advice goes for those who have extensive collections of firearms, baseball cards, model trains, toy soldiers, or antiques. While you’re at it, take inventory of all the other personal items of value , too.

“Take the time to determine the value of your contents: Your clothing, furniture, electronics, jewelry, artwork, items in your attic, pretty much anything that is not permanently attached to your house,” said David Cunningham, managing partner at 16Lombard, an insurance firm specializing in high-value items.

“Then, add the value of your military artifact collection to the value of your contents, so that you can compare that value with your current homeowners’ insurance policy under ‘contents’ to make sure you have enough coverage should a large loss occur,” explained Cunningham. “If you don’t have adequate coverage, consider insuring your collection separately. This is called a schedule, or floater, and usually provides broad coverage, including breakage, with no deductible. As far as what to cover, it is not necessary to insure everything with a schedule. If the collection is relatively small — $10,000 or less — those items will be easily covered under your homeowner’s policy contents coverage.”

For those with more extensive collections, that is where the schedule, or “floater,” comes into play. The collection can be insured separately from your TV, household items, and other non-collectible items. Keeping track of values is extremely important at this point. Militaria is often bought with cash at shows without receipts. Some companies may require an appraisal.

“It’s a good idea to obtain appraisals for items of higher value, i.e., $5,000. Insurance companies will require them to have an appraisal,” said Cunningham.

This threshold varies by company, and some are as low as $5,000 and some are as high as $100,000.

“We have a single item maximum limit of $10,000.00,” said Rielly, who added that items of a higher value need that special schedule.

“My belief is it is best to get an appraisal, or at least have receipts, for a $5,000+ item to avoid any issues with claims,” said Cunningham. “The key is being able to justify the value of the collection to the insurance company should a large loss, like a fire, occur.”

He also recommends that for larger collections ($10,000 or greater) that you have a video or photographic inventory, and to keep the video or photos in a safety deposit box or fireproof safe or off-site including the “cloud.”

“Keeping receipts is always a good idea, as well. This will help validate cash transactions that often occur at shows,” added Cunningham.

Collections on Display

One issue that is also misunderstood by some is where a collection needs to reside within a home. Those with large firearms collections often have safes or even vaults, while others like to display everything in a “man cave” setting.

Most insurers don’t have requirements, however. While a safe can be a good idea — or even required by law in some states — it won’t lower premiums.

“Safes are not a requirement, but we suggest that it is always a good idea to have firearms locked away, and there are state or city gun safety rules that need to be adhered to as well,” said Rielly. “However, whether you have a safe or not is built in the rate. We understand that most firearms collectors take great pride in their collections and do everything they can to protect it.”

For the same reasons, alarm systems and security cameras might be a good idea. These rarely reduce the premiums on insurance, however.

Then there is the issue of larger items that might not even be within a house. That vintage cannon, field gun, or even tank that you display outside can be insured.

“There are qualifications, and again the single item maximum limit is $10,000 generally, but we have clients who have tanks, as well as cannons, and these are insured,” said Rielly.

Controversial Items

One reason to go with a company that deals in collectibles is that these people — to take a line from a popular insurance company’s commercial — have seen it all. The big name firms might ask questions about those old boots that date back to before the Civil War really being worth several hundred dollars. Likewise, in today’s politically correct world, explaining why you collect Third Reich daggers or medals is a conversation that could be uncomfortable, to say the least.

As the saying goes, “I don’t know art, but I know what I like” fits the insurance companies that deal with collectibles. They understand they don’t need to know it, to accept why you like it! So those Nazi banners, Viet Cong flags, and busts of Lenin can all be insured.

However, there are still some items that fall into a gray area and others that can’t be insured. For one thing, an illegally owned machine gun can’t be insured, nor can any other item that can’t legally be owned.

“Items that are considered offensive can be insured, if they have value as a collectible, but there are certain items that cannot be insured,” said Cunningham. “A client of mine had over $1 million in gold bars from WWII he wanted insured. That was not approved by the insurance company due to gold being a commodity. Another had a collection of live grenades. The insurance company did not provide coverage for obvious reasons!For unique items, it’s best to consult your insurance agent or insurance company.”

An important issue for both collectors and dealers alike is that of fakes. Actually, insurance can come in quite handy for both buyers and sellers if a fake is involved, provided they have the right coverage.

“Fakes are a big issue,” said Cunningham. “For collectors, it is mostly ‘buyer beware,’ but they can have some legal recourse against a dealer if they can prove negligence or dishonesty. Dealers can purchase ‘Errors and Omissions’ insurance to cover them if they inadvertently sell a fake and are held liable.”

And as noted, it isn’t just collectors that should consider insurance. For those who make their living as militaria dealers it can be a good idea to get specialty coverage as well.

It is beyond the scope of this article to go into those details, but Cunningham offered this insight: “There are specific insurance coverages for dealers that cover many scenarios, such as theft; if a customer breaks an item while looking at it; or someone is injured by an item.”

And, as with the appraisals, it is recommended that collectors (and dealers) keep a detailed inventory. After a disaster, folks don’t tend to remember every item they had. Prices and condition — as well as replacement costs — aren’t going to be top of mind.

“Prepare before disaster strikes by having an inventory of your collection in a safe place, keeping appraisals and receipts and most importantly, having adequate insurance coverage so you are not ‘out of pocket’ a significant amount of money should a loss occur,” suggested Cunningham. “After the loss occurs, collectors should take reasonable steps to minimize the loss, while not jeopardizing safety, of course.Also, contact your insurance agent and company as soon as possible.”