WHY NOT “PAY IT FORWARD?”

“I am 84 years old” the call began. “I have had my WWII Jeep for more than 30 years. What should I do with it?” Over the past two decades,…

“I am 84 years old” the call began. “I have had my WWII Jeep for more than 30 years. What should I do with it?” Over the past two decades, I have received variations on this call almost every month. Change the caller’s age and the item in question, but essentially, the question is the same, made by someone who is just realizing their mortality: "What should I do with the collectible I have loved so much?"

With that much practice, you might think I could rattle off concrete advice to someone struggling with how to dispose of their historic military vehicle or collection. The truth is, I tend to stammer while I grasp for the words. Generally, I throw out the disclaimer, “It is your item, I can’t tell you what to do with it.”

I think I stumble for an answer because, over the years, I have come to understand what the callers are really trying to say: “I have cared about this stuff all these years, who will care for it after I am gone?” Tough stuff.

This isn’t going to be another blog on planning your exit strategy well in advance of your final days. That last phone call caused me to consider another strategy: Paying it forward.

After discussing all sorts of pricing concerns like condition and originality, the old-timer still couldn’t come up with his own price. “How much would you ask if it was your Jeep, John?” The stammering really began then! But then I recalled what a friend said to me long ago when he sold me a Model 1853 Enfield Rifle: “I paid $150 for it years ago. I have enjoyed it so much over the years—instead of going to movies or out for supper, I sat in my war room where this rifle hung. That’s a whole lot of entertainment that I received from that old gun, so I will sell it to you for $150. When you are done with it, you do the same.”

Collecting is not Investing

Somewhere back in the 20th century, people began to confuse “collecting” with “investing.” It is a response that plays out often during economic uncertainty. Long ago, investors realized tangible assets can weather any storm on Wall Street.

My first exposure to "tangible assets" was when I was a kid back in the early 1970s. At our grocery store, we sold a whole lot of hog bellies — just a fancy term for the cut—sometimes meaty, but always fatty—that hangs from a pig’s abdomen. Ultimately, most pork bellies are processed to become bacon (or salted to become “salt pork” or left untreated and sliced into “side pork").

After I heard the “pork belly futures” on the radio, I asked my Dad why pork bellies were part of the morning agriculture report. He explained, “ Some people want to invest their money in something they can see. Stocks are just too uncertain for them. So, they buy pork bellies.” Okay, I admit, that really wasn’t much of an explanation, but it was enough for a 12-year-old.

Over the years, Dad’s explanation about investing in pork bellies began to make more sense to me. I remember the “gas wars” of the 1970s when my brothers would drive 30 miles to Wisconsin to fill up cans with gasoline because it was unavailable in our little Minnesota town. I also recall the run on gold and silver during the “Hunt era” in the late 1970s and early 1980s. Again, in the 1990s, people began throwing lots of money into the muscle cars of their youth. In the last 30 years, art, guitars, cigars, and bourbon have all entered the realm of "investments." Examples of investing in tangible assets instead of the less-visible stock or bond markets are endless. In fact, it was during this descent over the last forty years that the confusion between “collecting” and “investing” became clouded— even confused.

The stock market is a complicated machine that many people feel in incomprehensible. But, they can understand a room full of guns, a couple of historic vehicles in the garage, or even a freezer full of pork bellies (to be fair, I don’t know of anyone who purchased actual slabs of pork bellies as a form of investment—investors traded on pork belly futures. It’s just a whole lot more fun to imagine someone coming home with a station wagon packed to the roof with bellies announcing to his wife, “Baby, we are ready for retirement!”).

Tangible assets became a good excuse for not investing in the invisible stock market. In our hobby, I have heard it said many times, “My ‘retirement plan’ is right here in my collection!”

Well, good luck to you if you are one of those collectors. Too often, I have received calls from the widow or family of someone who held clung to that strategy right into the grave. The bereaved are tormented even further when they learn that the payout on the dearly departed's collection is generally a fraction of what the collector claimed it was worth.

The over-valuing versus actual payout is because collecting is an unregulated market. There are safeguards in the stock market (and even the now-defunct pork belly market) that protect investors from fluctuations brought on by tragedies such as death, oil spills, earthquakes, theft, etc. Apart from specialty insurance policies, there aren’t those kinds of safeguards in our hobby. This is what makes thinking of our collections as investments a really, really bad idea. You might have a Henry Rifle hanging on the wall or a Willys MA parked in the garage, but if you drop off the toilet, dead as the flies on the window sill, there are NO guarantees that Henry or Willys will go to a new owner for the current market value.

Advice is worth the price paid and a cup of coffee.

When someone would ask my Dad's advice about how to invest money, he always replied, “My advice is worth the price you paid for it plus a cup of coffee.” He knew that his opinions were just that — his opinions. If an investment worked for him, there was no guarantee it would work for the neighbor down the street.

So, to get back to the old-timer who called asking me what he should do with his Jeep, my advice was just that — my opinion. Remembering my buddy who sold me the Enfield for $150, I told the old-timer, “If it were me, I would find someone just getting started in the hobby, and I would sell him the Jeep for $5,000 (a restored WWII Jeep will usually sell anywhere from $12,500-$20,000).”

“Oh, I could never do that — I have more than that in it!” was his response. I actually didn’t expect him to say, “Oh now that is a good idea.” But why not? If he had paid $5,000 for the Jeep 35 years ago (it was probably much less), why not “pay it forward?” He had 35 years of enjoyment with the vehicle. He was the caretaker of a piece of history, so why not give the same opportunity to someone just beginning their journey of exploring and learning about our military heritage? Where was it written that you can lock down a piece of history for 35 years just so you can make a profit off it?

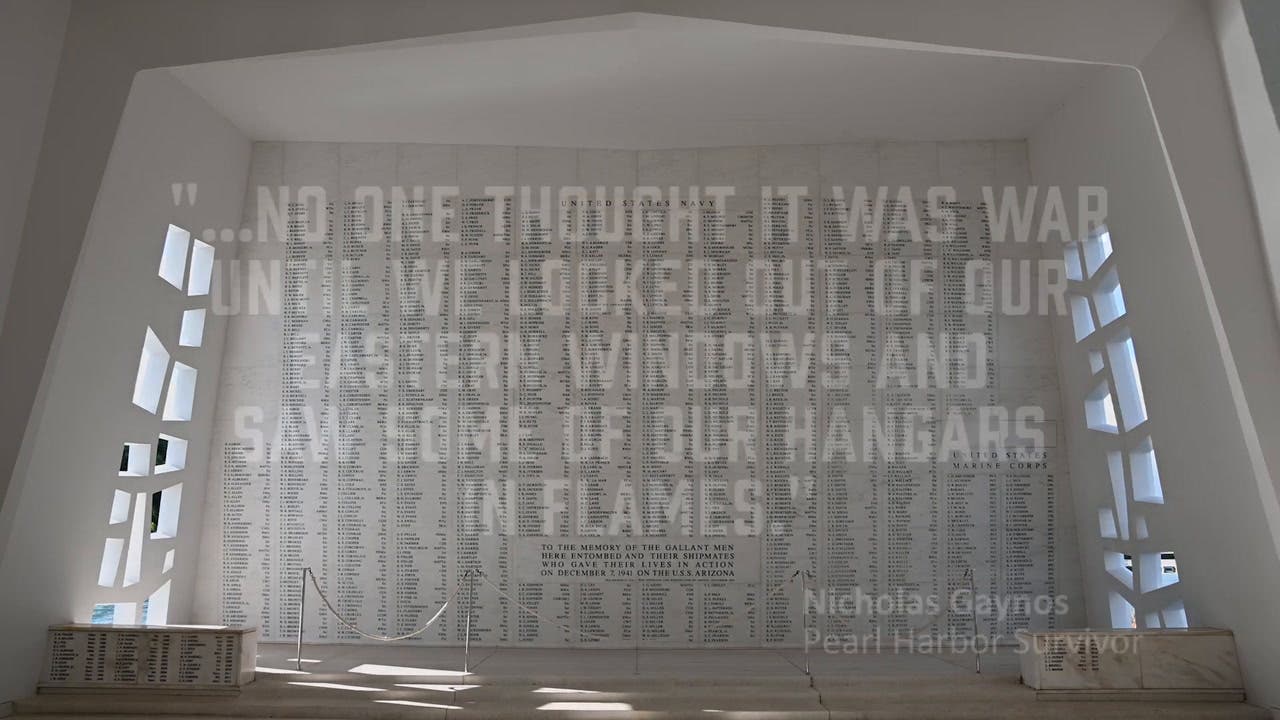

Somewhere, our great hobby derailed. History is not a commodity. The investment is in the preservation of heritage, not our economic well-being. Investing is better done in markets that are regulated and protected — like pork bellies or grain futures. Jeeps, helmets, medals, and all bits of militaria are better investments in our collective sense of heritage — in that, the returns are guaranteed.

Preserve the memories,

John Adams-Graf

Editor, Military Trader and Military Vehicles Magazine

John Adams-Graf ("JAG" to most) is the editor of Military Trader and Military Vehicles Magazine. He has been a military collector for his entire life. The son of a WWII veteran, his writings carry many lessons from the Greatest Generation. JAG has authored several books, including multiple editions of Warman's WWII Collectibles, Civil War Collectibles, and the Standard Catalog of Civil War Firearms. He is a passionate shooter, wood-splitter, kayaker, and WWI AEF Tank Corps collector.